Commercial Real Estate Outlook 2018.

Optimize opportunities in an ever-changing environment

How can real estate executives adapt their business models to keep up with the evolution of their ecosystem? Here are four priority areas for 2018 that may help them bridge the gaps while maximizing value and growth.

Create value amid uncertainty and change

The real estate (RE) industry seems to be on an accelerating disruption curve highlighted by rapid changes in tenant dynamics, customer demographic shifts, and ever-increasing needs for better and faster data access to allow improved service and amenities. A case in point: the ongoing development of the 18-million-square-feet Hudson Yards megaproject in New York City.1 This $25 billion mixed-use redevelopment on Manhattan’s West Side integrates technology with real estate development.

Hudson Yards is expected to be a connected, sustainable, and integrated neighborhood of residential and commercial buildings (retail, hotels, and office), streets, parks, and public spaces.2

Hudson Yards and some other forward-looking developments are focusing on items such as heat mapping to track crowd size and energy usage, opt-in mobile apps to help collect data about users’ health and activities, and energy savings using a microgrid. These and other fascinating innovations show some of the initiatives RE companies are deploying to respond to the overarching themes of our Outlook reports of the last two years—technology advancements that are disrupting the ecosystem and innovations that can help companies effectively prepare for a dynamic future.

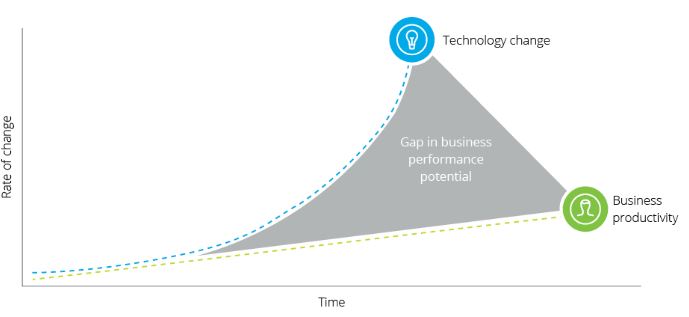

Clearly, cities today are no longer mere aggregations of buildings and people. Moving forward, as the industry prepares for smart cities and mobility, RE companies seem to have no choice but to be constantly aware of new developments in this demanding ecosystem. At a broader level, there are fast-paced advancements in mobile computing (5G technology), cognitive, and artificial intelligence, and use of enhanced data-gathering tools such as sensors, which are widening the gap between changes in technology and business productivity (see figure 1). Often layering into the rapid change are workforce shifts in age, gender, and race that are affecting how we do business and redefining both cultural norms and “job/career satisfaction.”

Figure one: Change in technology vs. business productivity

Source: Josh Bersin, Bill Pelster, Jeff Schwartz, Bernard van der Vyver, “2017 Deloitte Global Human Capital Trends: Rewriting the rules for the digital age,” February 28, 2017.

These ecosystem developments appear to signal more change and uncertainty, and may even confuse many RE executives about the best way to move forward. We believe that companies should consider to look within at current processes and people and evaluate different ways to bridge the gap between technology advancements and business productivity. Based on in-depth research and analysis as well as extensive discussions with industry professionals, we expect that RE companies could maximize value creation and growth by prioritizing the following four themes as they plan for the next 12-18 months:

Accelerate business: Unlock the value of real estate investment trusts (REITs)

Avail alternative capital options: Focus on RE fintech startups

Augment productivity: Embrace robotic and cognitive automation (R&CA)

Advance people: Reimagine talent and culture

Overall, with the continuous shift at all levels—core business, tenants, and people—RE companies may have to take some risks and show dexterity in embracing change and adapting for the future.

The real estate (RE) industry seems to be on an accelerating disruption curve highlighted by rapid changes in tenant dynamics, customer demographic shifts, and ever increasing needs for better and faster data access to allow improved service and amenities.

Unlock the value of REITs: Accelerate business

What is the new market expectation when it comes to value?

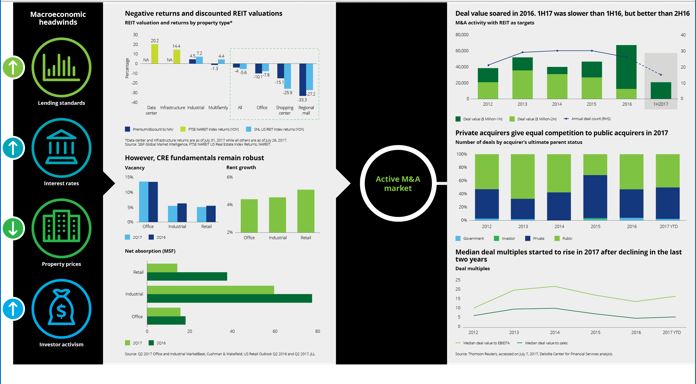

Currently, many traditional REITs are trading well below their net asset values (NAVs). Consider these statistics: As of July 26, 2017, the SNL US REIT Equity index was down 5.6 percent year-over-year (YOY) compared with the 14.2 percent rise in the S&P 500.3 Among REIT subsectors, retail and office REITs have been the most impacted with negative YOY returns of 25.5 percent and 7.8 percent, respectively.4 Overall, REITs are trading at a 4 percent discount to NAV, with regional malls trading at a historically high discount of 33.3 percent.5 Certainly, a lot of value has been eroded, despite the fact that commercial real estate (CRE) fundamentals remain strong with positive rent growth and net absorption and stable vacancy rates across nearly all core property types.6 In contrast, the nontraditional REIT peers, such as those focused on telecom towers and data centers, continue to outperform traditional REITs and even the broader market indices. For instance, as of July 31, 2017, FTSE NAREIT indices for infrastructure REITs and data center REITs rose 14.4 percent YOY and 20.2 percent YOY, respectively, while the S&P 500 returned 13.7 percent in the same period.7

So what could be bothering investors and markets about traditional REIT stocks? We believe there could be three factors.

First, the market could be discounting traditional REIT stock prices for the broader macroeconomic trends, such as rising interest rates, tightening lending standards, and perceived heated property valuations.

Second, REIT stocks are likely being impacted by the influence of market trends that are impacting tenants. The media coverage or the carryover stigma of certain industries most affected by disruption could be the Achilles’ heel for high performing large REITs, even those with class-A properties. This could very well be the case with class-A mall REITs.8

Third, the rise in investor activism in the real estate space is perhaps delaying decisions that create higher shareholder value in the long term. To put this in perspective, the number of activist campaigns rose to 23 in 2016 compared with just three in 2010, and certain other estimates suggest that 15 percent of all the activist campaigns in 2016 targeted the real estate sector.9 Many of these activities are aimed at just making short-term gains or are related to concerns around capital allocation and corporate governance.10 As an example, many investors tend to raise concerns about the boards’ rights to amend bylaws without shareholder approval and provisions of the Maryland Unsolicited Takeover Act, which, among other things, allows REITs to independently stagger their boards.11 Further, the separate Global Industry Classification Standard (GICS) classification of real estate as a separate sector has increased interest from generalist investors who, in many cases, may not have the sophisticated level of understanding that REIT-dedicated investors have. As a result, many REITs are striving to find the balance between prioritizing short-term considerations to respond to shareholder activists and making necessary investments, such as in technology that could drive value in the long term.

In any case, the above macroeconomic and sectoral trends have driven M&A activity in the REIT sector—in 2016, deal value rose 44.2 percent YOY to $66.9 billion, the highest since 2006.12 Interestingly, the number of deals in 2016 was a tad lower than the prior year, indicating larger average deal size. In the first half of 2017, deal value has been lower than in the first half of 2016, but higher than in the second half of 2016. Please refer to figure 2 for more details.

Figure two: Numberspeak | Factors affecting REIT valuations

Source: Josh Bersin, Bill Pelster, Jeff Schwartz, Bernard van der Vyver, “2017 Deloitte Global Human Capital Trends: Rewriting the rules for the digital age,” February 28, 2017.

These ecosystem developments appear to signal more change and uncertainty, and may even confuse many RE executives about the best way to move forward. We believe that companies should consider to look within at current processes and people and evaluate different ways to bridge the gap between technology advancements and business productivity. Based on in-depth research and analysis as well as extensive discussions with industry professionals, we expect that RE companies could maximize value creation and growth by prioritizing the following four themes as they plan for the next 12-18 months:

Accelerate business: Unlock the value of real estate investment trusts (REITs)

Avail alternative capital options: Focus on RE fintech startups

Augment productivity: Embrace robotic and cognitive automation (R&CA)

Advance people: Reimagine talent and culture

Overall, with the continuous shift at all levels—core business, tenants, and people—RE companies may have to take some risks and show dexterity in embracing change and adapting for the future.

The real estate (RE) industry seems to be on an accelerating disruption curve highlighted by rapid changes in tenant dynamics, customer demographic shifts, and ever increasing needs for better and faster data access to allow improved service and amenities.

Unlock the value of REITs: Accelerate business

What is the new market expectation when it comes to value?

Currently, many traditional REITs are trading well below their net asset values (NAVs). Consider these statistics: As of July 26, 2017, the SNL US REIT Equity index was down 5.6 percent year-over-year (YOY) compared with the 14.2 percent rise in the S&P 500.3 Among REIT subsectors, retail and office REITs have been the most impacted with negative YOY returns of 25.5 percent and 7.8 percent, respectively.4 Overall, REITs are trading at a 4 percent discount to NAV, with regional malls trading at a historically high discount of 33.3 percent.5 Certainly, a lot of value has been eroded, despite the fact that commercial real estate (CRE) fundamentals remain strong with positive rent growth and net absorption and stable vacancy rates across nearly all core property types.6 In contrast, the nontraditional REIT peers, such as those focused on telecom towers and data centers, continue to outperform traditional REITs and even the broader market indices. For instance, as of July 31, 2017, FTSE NAREIT indices for infrastructure REITs and data center REITs rose 14.4 percent YOY and 20.2 percent YOY, respectively, while the S&P 500 returned 13.7 percent in the same period.7

So what could be bothering investors and markets about traditional REIT stocks? We believe there could be three factors.

First, the market could be discounting traditional REIT stock prices for the broader macroeconomic trends, such as rising interest rates, tightening lending standards, and perceived heated property valuations.

Second, REIT stocks are likely being impacted by the influence of market trends that are impacting tenants. The media coverage or the carryover stigma of certain industries most affected by disruption could be the Achilles’ heel for high performing large REITs, even those with class-A properties. This could very well be the case with class-A mall REITs.8

Third, the rise in investor activism in the real estate space is perhaps delaying decisions that create higher shareholder value in the long term. To put this in perspective, the number of activist campaigns rose to 23 in 2016 compared with just three in 2010, and certain other estimates suggest that 15 percent of all the activist campaigns in 2016 targeted the real estate sector.9 Many of these activities are aimed at just making short-term gains or are related to concerns around capital allocation and corporate governance.10 As an example, many investors tend to raise concerns about the boards’ rights to amend bylaws without shareholder approval and provisions of the Maryland Unsolicited Takeover Act, which, among other things, allows REITs to independently stagger their boards.11 Further, the separate Global Industry Classification Standard (GICS) classification of real estate as a separate sector has increased interest from generalist investors who, in many cases, may not have the sophisticated level of understanding that REIT-dedicated investors have. As a result, many REITs are striving to find the balance between prioritizing short-term considerations to respond to shareholder activists and making necessary investments, such as in technology that could drive value in the long term.

In any case, the above macroeconomic and sectoral trends have driven M&A activity in the REIT sector—in 2016, deal value rose 44.2 percent YOY to $66.9 billion, the highest since 2006.12 Interestingly, the number of deals in 2016 was a tad lower than the prior year, indicating larger average deal size. In the first half of 2017, deal value has been lower than in the first half of 2016, but higher than in the second half of 2016. Please refer to figure 2 for more details.

Figure two: Numberspeak | Factors affecting REIT valuations

Where should companies start?

There are many ways traditional REITs can consider to unlock value, including revisiting corporate governance and communication strategy, optimizing property portfolios, and reassessing the public status.

Revisit corporate governance and communication strategy: In light of changing investor demography and activism, REITs would benefit from improving transparency by reassessing existing corporate governance practices and communication strategy. This is important, as the acid test for every public company is how well it succeeds in managing investor confidence and risk perception. REITs would have to be more inclusive and transparent in selecting board members, designing the governance framework and structure, and assigning roles and responsibilities.13

REIT boards would also have to work more collaboratively and communicate more frequently with various stakeholders, such as management, regulators, and investors. Along with frequent, tailored, and timely communication, REITs should evaluate the channel and content.

From a channel perspective, REITs are likely to benefit from a combination of in-person and online investor outreach programs. According to a March 2017 NAREIT survey of REIT investor relations professionals, two-thirds do not use social media as part of their investor relations strategy and most of them prefer traditional communication techniques.14

From a content perspective, REITs have an opportunity to use the latest visualization and analytical tools to provide business insights. For this, they can increase technology investment to consistently measure and analyze the company and market performance and possibly enhance their forecasting ability.

Optimize property portfolio: Strategic portfolio optimization is another possible way to unlock shareholder value. Companies can consider reassessing their property portfolio to identify and shed non-core assets or unlock value through spin-offs. Property and portfolio disposition involves sophisticated financial modeling and analysis of current and future financial projections to identify non-core properties and the impact on the financial performance of the REIT going forward. Spin-offs can be even more complicated. REITs should evaluate whether the portfolio to be separated has the scale and the management team to be successful as a standalone entity, and would also need to convince shareholders and investors of the financial benefits of the transaction.

Alternatively, REITs can assess the size and scale they need to achieve in order to compete on cost of capital, develop long-term multichannel relationships, operate efficiently and effectively, and attract key talent. In addition, consistent with the investor communications discussion above, REIT executive management needs to be able to communicate to the investor community the specific benefits of scale. In fact, out of the 10 US REIT mergers announced in the first half of 2017, six were aimed at building scale by expanding presence in new geographic markets and/or property types.15

Finally, as part of overall portfolio optimization, REITs can continue to increase investments in technologies to create operational efficiencies and improve topline growth. For instance, companies can target higher proportions of smart buildings in their portfolios to provide more value to owners and occupiers in the form of lower operating expenses, such as energy costs, improved health and productivity benefits through smarter heating, ventilation, and air-conditioning (HVAC), and lighting; and tighter security due to real-time monitoring and faster emergency response systems.16 For revenue optimization, companies can make more informed decisions based on data and insights from the Internet of Things or IoT sensors and transparent market information, such as lease comparables. Companies can combine, analyze, and present insights from the large sets of sensor data in a manner that tenants or other stakeholders can leverage in order to better predict behaviors and thus augment their decision making.17

Challenge public/private status: While public REIT status has the benefits of liquidity and easier access to capital, it also entails higher costs in terms of administrative and regulatory requirements. In addition, many believe that the public markets are challenged in determining the value for current and future development opportunities, and discount them more than private markets. In times of lower market valuations, REITs could do well to conduct a cost-benefit analysis to assess whether their current scale and valuation justify the costs of remaining public and listed. At times, the cost of compliance with regulations from the US Securities and Exchange Commission (SEC) and Sarbanes-Oxley, maintenance of investor relations and public reporting groups, and other overhead associated with being public can more than offset the cost of capital benefits of being public. In the case of higher costs and stakeholders being open to privatization, companies can look at strategic or financial buyout transactions as private institutional investors continue to scout for opportunities in the public space.18 In fact, there could even be opportunities to bring private capital into hard-to-value segments of a REIT’s business, such as development, to provide a better indicator of the value of the development opportunities and perhaps drive a lower overall cost of capital. For example, the REIT could raise a fund from institutional investors or joint venture with private equity investors to fund development projects.

The bottom line

Unlike in past years, REIT valuations today are increasingly impacted by investor activism and media attention. This is compounded by the current dilemma faced by many REITs of highlighting the intrinsic value and base fundamental economic improvements compared with the perceived value. To unleash this value, companies should consider different approaches to reinstate shareholder enthusiasm. This would require critical assessment of existing corporate governance and communication strategies and also the current state of operations, growth opportunities, and strategic alternatives, which may lead to M&A or company structuring considerations.

Focus on RE fintech startups: Avail alternative capital options

Why should companies focus on RE fintech startups?

Technology startups seem to be here to stay. Rapid advancements in technology have lowered entry barriers for tech startups. For more than 15 years, the cost of establishing an internet-based startup has reduced substantially, from $3 million in the 1990s to just $300 today.19 And in the recent past, these startups have become more and more synonymous with disruption and innovation.

The last decade has witnessed an exponential growth in RE tech startups. Globally, the number of RE tech startups rose from 176 in 2008 to 1,274 by 2017.20 In the same period, cumulative investments in these startups soared from $2.4 billion to $33.7 billion.21 While venture capital (VC) remains the dominant funding source, there is substantial capital flow from non-VC investors as well, including REITs, established real estate services companies and investors, private equity firms, and high net worth individuals. In the five-year period between 2011 and 2016, funding from non-VC sources for RE tech startups increased at a compound annual growth rate (CAGR) of 65.7 percent to $2.3 billion in 2016.22 And there is an all-time record funding of $5.8 billion year-to-date (YTD), as of September 18, 2017.23 Please refer to figure 3 for more details.

For the purposes of this outlook, we’ve categorized RE tech startups into two categories: RE operations and RE fintechs.

Operations-related tech startups focus on the core real estate business, such as property search, leasing, facility management, smart building technologies, and home services.

RE fintechs are enabling financing and investments in real estate. They offer diverse services and solutions, such as real estate transaction services, digital lending platforms for CRE owners and lenders, online real estate investments options for individuals, and investments in single-family homes for institutional investors.

The general notion is often that startups are a threat to incumbent RE companies. And this may be true, as with the help of technology, they are indeed offering innovative solutions and enhanced user experiences at a relatively lower cost, faster pace, and with a user-friendly environment. Take the case of startups that directly compete with REITs by providing online investment avenues for individuals to invest in CRE.24 Also called eREITs, their solutions combine the features of nontraded REITs and crowdfunding, with lower fees.25 However, unlike traditional crowdfunding ventures, eREITs offer multiple and diversified asset-lending services. Large crowdfunding firms, such as Fundrise and RealtyMogul.com, have been key proponents of eREITs so far.26 Even companies such as RealtyShares provide similar investment opportunities in CRE and are looking to potentially compete with traditional REITs. As such, RE fintech startups comprise only 3.2 percent of the overall global RE tech startup space by investments, having raised $1.1 billion so far, but they are certainly disrupting traditional business models.27

Alternately, there are many ways in which traditional RE companies can benefit from the solutions offered by RE fintech firms. The platforms these firms provide can expand and diversify the lender base and enable more individuals and institutions to get exposure to real estate. This is especially useful for US-based companies, which face a challenging financing environment, where traditional lenders such as banks are tightening lending standards and commercial mortgage-backed securities (CMBS) issuances remain well below their historical highs due to the implementation of the new regulations following the 2008 financial crisis. In light of the fact that the global online lending industry is expected to grow from $40 billion in 2016 to over $1 trillion in the next five years, the growth in CRE financing may very well be led by these RE fintechs.28

Figure three: Numberspeak | RE fintech overview

Where should companies start?

The fintech onslaught cannot be ignored. Traditional RE companies can benefit by engaging with these startups in different ways. Companies can make choices based on their investing capacity, the utility of a startup’s services, its need for financing, and so forth. As end users, RE companies can leverage some of the online services and solutions for key property-related decisions. Companies can also access capital by using the innovative funding and investing platforms that RE fintechs have to offer. Alternately, they could partner with the RE fintechs for meeting their financing and investment needs. Finally, RE companies can invest in them and benefit from their growth.

Use RE fintechs’ services: CRE owners, developers, and investors can use RE fintech platforms for a variety of services—including leasing, acquisition, disposition decisions, managing the underwriting process, and accessing detailed financial models for property financing. The most obvious and key benefits would be efficiency and convenience as these online and sharable solutions have the capability to provide analysis faster, cheaper, and more efficiently.29 As an example, Assess+RE provides cloud-based services such as property-level valuation models and related financial analysis.30

Partner: CRE owners, operators, and developers can collaborate with startups to raise equity, secure joint venture partners, or even sell their properties by gaining access to accredited and institutional investors. Cadre, with $133.3 million in funding, is one such platform that helps connect CRE owners, operators, and investors.31,32 CRE owners can also partner with startups to finance projects and obtain loan offers from a diverse set of lenders, including banks, private equity firms, and crowdfunders. For instance, digital lending marketplaces, such as StackSource, help connect CRE owners and lenders.33

Invest: RE companies that have a fair understanding of the startup business, substantial funds, and the appropriate risk appetite can invest in fintechs with a strong value proposition. RE companies could take this route for a variety of reasons, including relevance to existing business or future strategy and the desire to gain knowledge of the startup’s technology or other intellectual property. In some instances, RE companies may want to create value for the startup by sharing their expertise and/or relationships or even contributing to the startup’s business by being customers for its products or services.

The bottom line

The RE space is witnessing significant action. Almost every day, new headlines appear about digital initiatives, digital incubators/innovation teams, acquisitions or collaboration with nimble fintech firms, and more. Startups are constantly incubating new ideas as they continue to increase in size and services. As such, traditional RE companies can potentially benefit from collaborating with the fintech startups. However, they would need to assess their engagement approach with the fintech startups, as the latter has a significantly different style of operations.

Embrace robotics & cognitive automation (R&CA): Augment productivity

Why should companies consider R&CA?

Automation is transforming the industry, changing the nature of work and helping companies go beyond conventional barriers. RE companies have been rather slow to adopt technology effectively and this reflects in the many operational inefficiencies that plague the industry today.

For example, many RE companies continue to use spreadsheets for recording, collating, and analyzing data for cost aggregation, lease administration, invoices, accounts payables, property valuation, and forecasting. However, many other businesses in other industries (and some of the technology leaders among RE companies) use sophisticated analytical tools on gathered data to provide enhanced business intelligence and visualization.

Further, as an example, a deeper dive into an RE company’s lease accounting and administration processes suggests that many documents—such as lease agreements, deeds, brokerage contracts, vendor payables and credit applications, property management agreements, and property tax assessments—are still maintained in a physical (either scanned or spreadsheet) format. As a result, substantial time is often spent reading, manipulating, or abstracting paper or digital documents for relevant information. Many times, RE players are also challenged to perform in-depth analysis, as the data is not structured in the desired format. Consequently, companies typically employ dedicated teams for defining parameters and analyzing the data. More importantly, they are challenged to develop and capitalize on the insights locked within their documents to make informed decisions.

The high level of human involvement increases the probability of fraud and error. Research suggests that most errors in the accounting and tax functions tend to be the result of human involvement: deletion of spreadsheet formulas and incorrect manual calculations, multiple sources of data input, and storage of sensitive data on unsecured devices.34

R&CA technology can be a game changer in this evolving environment. A combination of robotic process and cognitive automation, it can help RE companies reduce errors and increase operational efficiency by replicating human actions and judgment at tremendous speed, scale, and quality, all at a relatively lower cost.

Let’s understand the two technologies in more detail.

First, robotic process automation (RPA) essentially uses software to automate many manual, repetitive and often rules-based processes and tasks.35 The technology has huge potential, with the market estimated to touch $16.9 billion in 2024, which reflects a CAGR of 47.1 percent during the 2016-2024 period.36

Second, cognitive automation uses machine learning capabilities for judgment-based processes and predictive decisions. Natural language processing, natural language generation, machine learning, cognitive analytics, and sensing are some of the cognitive capabilities that can revolutionize the RE ecosystem.

The implementation of R&CA can eliminate inefficiency inherent in many finance and accounting tasks—such as lease accounting and administration, invoice processing, and payroll management—by:

Optimizing costs: RPA can decrease costs drastically and may even end up being cheaper than offshoring.37 R&CA software can enable processing 24/7/365 without breaks and holidays.

Improving speed and accuracy: RPA can accomplish mundane and cumbersome tasks, such as extraction and digitization of data from lease contracts or invoices, faster and more accurately than people can.38 Studies have shown that using cognitive technology to generate actionable data from unstructured documents can increase efficiency by 4.5 times than traditional processes.39

Streamlining record management: Optical character recognition with cognitive technologies can enable lease records, invoices, and other essential documents that are usually recorded manually or scanned to be converted into formats suitable for reporting and analysis.

Enhancing compliance and risk monitoring: Given the rule-based nature of RPA, RE companies can automate many of their risk and compliance monitoring activities. As examples, tracking invoices for compliance with contractual terms or periodic review of lease contracts to avoid any potential risks of tenant defaults of any contractual obligation can be easily automated.

Allowing informed decision making: Use of cognitive extraction technologies such as natural language processing or NLP would allow companies to cull relevant data and information from unstructured documents fairly quickly. After that, RE companies can use a variety of tools and technologies to convert the unstructured data into a structured format and then visualize and generate actionable insights.40 For example, converting lease data into a structured format could also provide benefits to property management, lease administration, and billing processes as it would be easier to integrate the data and store it in a more centralized manner.

Eventually, RE companies would be able to enhance their overall productivity and utilize their employees to perform more meaningful tasks.

RE companies may also have to revisit their talent strategy, as the use of R&CA technologies may require them to train employees to do higher-order work that requires thoughtfulness and discernment. To know more about this, please read the “Reimagine talent and culture” section later in the report.

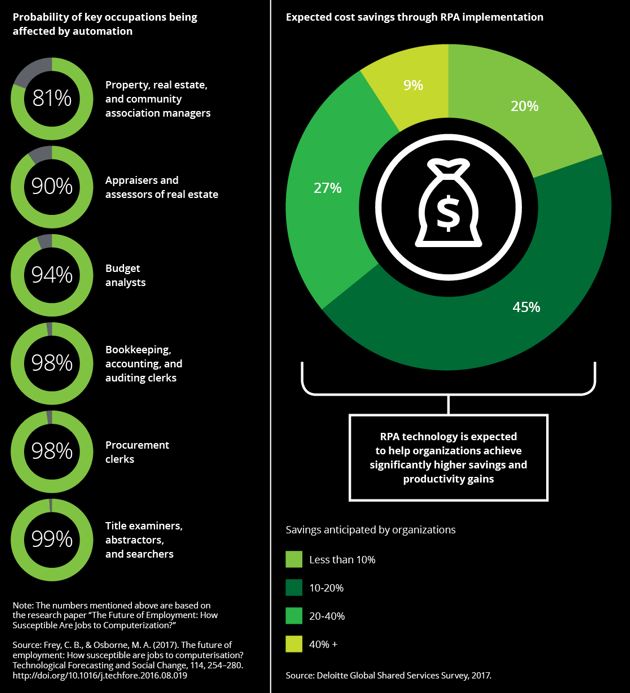

Figure four: Numberspeak | Expected automation of key RE occupations and cost savings through RPA implementation

Where should companies start?

Given the apparent benefits of R&CA technology, RE companies should consider evaluating processes and tasks that can be automated and the technology implementation approach.

Evaluate processes and tasks: To begin with, RE companies should assess current processes and tasks, and identify the tasks eligible for RPA and cognitive automation respectively or collectively.

Some of the key considerations could be a large volume and repetitive nature of work, scalability through the addition of labor, high incidence of errors, use of traditional workflow tools, budget constraints that are limiting system modernization, and workflows where decision making is based on disparate systems. Roles requiring perceptual human skills, such as handwriting recognition or facial identification, and other cognitive abilities, like planning and reasoning, could also be considered. Based on our analysis of some of the key jobs in the RE sector (highlighted in figure 4), we believe many property appraisal, budget analysis, accounting, bookkeeping, and auditing and property management related tasks are ripe for RPA application. RE companies may even consider using R&CA technology for future cash flow projections, billing, payables processing, and payroll applications.

Assess implementation approach: Along with assessing processes and tasks, RE companies would need to evaluate the technology implementation approach that they wish to pursue. This will largely depend on their budgets and estimated return on investment and the sense of urgency to automate existing tasks.

Along with this, RE companies should consider two more things, which go beyond financial considerations. First, it would be an imperative for companies to evaluate and implement data access, protection, and privacy measures based on the amount of tenants’ and employees’ personally identifiable information or PII processed using these technologies. Second, RE owners should acknowledge that the application of R&CA technology would enable the use of information and analysis across different functions. This would require more collaboration among a variety of stakeholders.

The implementation of R&CA can eliminate inefficiency inherent in many finance and accounting tasks—such as lease accounting and administration, invoice processing, and payroll management.

The bottom line

Like any new technology, R&CA typically comes with the promise to improve routine tasks radically by making them faster, cheaper, and more accurate. RE owners have an opportunity to embrace automation to drive operational efficiency and augment productivity. Over time, companies should consider using R&CA to create more value through improved decision making rather than just cost efficiencies.

Reimagine talent and culture: Advance people

Why should companies focus on talent and culture?

As real estate and construction (RE&C) companies adapt to today’s dynamic digital environment, they must also confront a unique and challenging talent situation. The workforce is becoming increasingly diverse by generation, gender, and other demographics. At the same time, it is increasingly working side by side with machines in a more hyperconnected and global environment. There is a high potential of shorter shelf-life for many employees’ existing skills.

These converging forces of business disruption and talent disruption are creating a perfect storm for RE&C companies.

RE&C companies are facing multiple talent concerns: an ever-increasing shortage of skilled workers, a relatively larger proportion of Baby Boomers in the workforce approaching retirement with significantly fewer Gen Xers in the population to replace them, and the industry as a whole being seen as an unappealing proposition for Millennials.41 In fact, the MIT Sloan Management Review and Deloitte Digital’s 2017 global study of digital business revealed that only 10 percent of the global RE&C respondents agreed or strongly agreed that their organization has sufficient talent today to support their digital business strategy.42

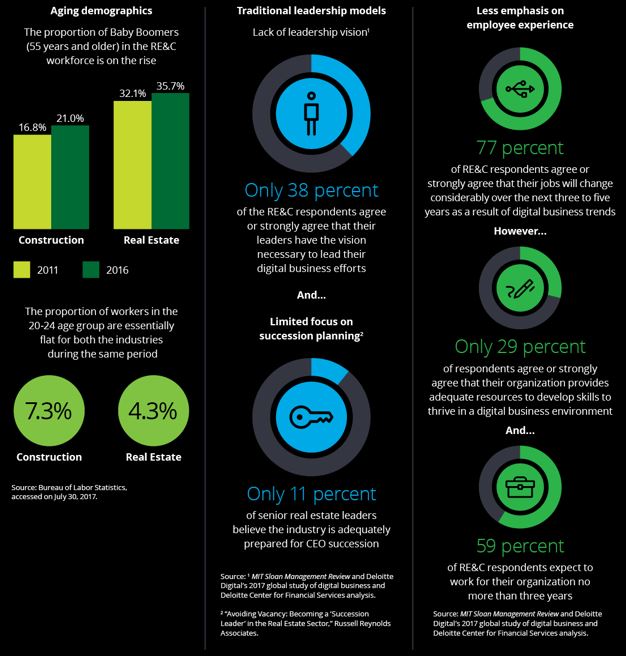

The current age demographics of RE employees are quite revealing and could be concerning. In the construction sector, the proportion of employees 55 years and older increased to 21 percent in 2016 from 16.8 percent in 2011.43 In the real estate sector, the situation may be even more concerning, with 35.7 percent of employees in the 55 years or older age category in 2016 compared to 32.1 percent in 2011.44 Research suggests that many RE&C companies aren’t effectively developing the next generation of leaders despite a tenured leadership.45 In addition, these leaders often follow a traditional hierarchical approach to leadership, where decision making is driven by positional authority and not skills or proficiency.46

In contrast, at 7.3 percent for construction and 4.3 percent for real estate, the proportion of workers in the 20-24 age group held constant during the comparable period.47 This may be due to many RE&C companies continuing to follow traditional and outmoded approaches to attracting and retaining talent and managing the organization. Consequently, the industry may hold little or no charm for prospective Millennial and Gen Z employees.48 RE&C companies, as a result, seem challenged in hiring skilled younger talent. As the findings of the 2017 survey of the Associated General Contractors of America showed, 73 percent of engineering and construction firms are finding it difficult to hire skilled workers.49

Further, the focus, or perhaps lack of it, on employee experience is another notable element that could be negatively affecting the culture at RE&C companies. For the purposes of this report, we use the term “employee experience” to describe how employees feel about their employer organization with regard to opportunities for growth, skills development, employee engagement, and willingness to continue to work for their current company.50 Legacy cultural attributes, which include a company’s adaptability to change, work style, leadership style, decision making, or for that matter, risk appetite may not be effective as work evolves and the war for talent intensifies.

Consider this: Only 38 percent of the RE&C respondents of the MIT Sloan Management Review and Deloitte Digital’s 2017 global study of digital business agreed or strongly agreed that the leaders have the necessary vision to lead a digital business. And 77 percent of RE&C respondents agreed or strongly agreed that they expect their jobs to change considerably over the next three to five years as a result of digital business trends. At the same time, only 30 percent of respondents agreed or strongly agreed that their organization provides its employees with adequate resources to develop skills to thrive in a digital business environment. This presumed lack of focus on digital readiness and the employee experience may be contributing to the lack of talent “stickiness” with which many current organizations seem to be struggling. Please refer to figure 5 for more details.

Figure five: Numberspeak | Talent, leadership, and cultural challenges faced by the RE&C industry

Where should companies start?

Clearly, RE&C companies should consider rethinking their approach to talent, employee experience, and organizational culture as the industry undergoes a digital transformation—if they are to stay viable. In order to thrive in this ongoing change, the predominant focus has to be threefold: tap the open talent economy, redefine existing leadership models, and enrich the employee experience.

Tap the open talent economy: RE&C companies should likely realize and accept the fact that the borderless talent economy is here to stay. Workers now take many forms—traditional “balance-sheet” employees, contingent workers who are part of the “gig” economy, contract outsourcers or “as a service” workers, and autonomous machines/robots. The best way forward for RE&C companies may be to integrate the concept of the open talent economy into their talent strategy.

This new open talent economy is “a collaborative, transparent, technology-enabled, rapid-cycle way of doing business.”51 It encompasses both traditional and alternative work arrangements, such as salaried workers, hourly employees, freelancers, temporary workers, independent employees, and open source talent.52 Interestingly, alternative work arrangements contributed to 94 percent of the net new employment between 2005 and 2015 in the United States.53 Given this rapid evolution of work, companies should consider more collaborative recruitment approaches, involving the business, human resources, and other relevant functions.54 RE&C leaders should consider creating a digital employer brand and using online social technologies to attract and engage with prospective millennial and Gen Z candidates throughout the recruitment process.

Redefine existing leadership models: As highlighted earlier, the possible lack of readiness of existing RE&C leadership to steer their organizations through the ongoing digital transformation of the industry and the pervasive lack of robust succession planning can be quite worrisome.

According to the MIT Sloan Management Review and Deloitte Digital’s 2017 global study of digital business, RE&C respondents considered an experimentation mindset, a risk-taking attitude, and a willingness to speak out as the three most important leadership attributes for leaders to demonstrate the ability to meet a company’s digital business transformation objectives.55

Certainly, today’s leaders need to transform into digital leaders, which may require them to think, act, and react differently.56 RE&C companies may want to consider streamlining to a relatively flatter and collaborative leadership structure, and start the process of identifying future leaders earlier. Additionally, RE&C companies should create experiential learning opportunities to hone the necessary leadership skills of existing and future leaders.57

Enrich the employee experience: RE&C companies should consider a holistic approach to enhancing the employee experience. This would happen when companies successfully align their culture with the evolving business, operating, and customer models.58 Companies should consider rewiring some of their core cultural attributes to include agility, collaboration, bolder risk appetite, distributed organization structures, and data-driven decision making. To explore these attributes in greater detail, please refer to our report, Digital transformation in financial services: The need to rewire organizational DNA.

Further, RE&C companies can improve their employee engagement by making it a business priority. Deloitte’s Simply Irresistible OrganizationTMframework suggests that five elements—meaningful work, hands-on engagement, positive work environment, growth opportunity, and trust in leadership—would allow companies to increase engagement.59 Examples of how companies manifest this include time and location flexibility so that employees can better balance their personal and professional lives, corporate social responsibility opportunities that give a sense of purpose by connecting the company and its employees with the community, and customized learning and development programs to cater to a more diverse workforce.

As a case example, to enhance its employee experience, CBRE Group, Inc., a CRE services company, is redesigning its workplace to promote collaboration.60 The company is using a comprehensive approach to improve employee engagement. Among others, they are offering flexible work options and targeted community improvement activities.61 CBRE also has robust learning and development programs and platforms for self-paced training and structured professional development programs using immersive learning and mentoring techniques.62

The bottom line

It seems the right time for RE&C companies to make talent, the employee experience, innovative leadership, and culture part of their strategic priorities. This would allow companies to better prepare for a digital future and to build these capabilities as a competitive talent differentiator. The way forward is likely not going to be easy. Many RE&C companies may have to rewire existing behaviors and remodel key aspects of their HR function—recruitment, the employee experience, organizational design, and leadership development, for example. But, as the future of work evolves with the open talent economy and accelerating advancements in cognitive technologies, machine learning, and artificial intelligence, RE&C companies will likely have to be agile, innovative, and collaborative to continue to stay ahead of their competitors in the race for positive financial impact. The choice is clear: Keep pace with the changes in the environment around us or slowly become irrelevant.

Chart the path to create value and grow

RE companies face myriad challenges today—from the way technology has leapfrogged into every aspect of the industry to cultural changes, which if not embraced, threaten to render companies or the service they deliver obsolete. In the face of this, how do companies enhance value and propel growth?

RE companies should be sharp as a tack and acknowledge that the dimensions of value creation and growth are changing rapidly. Using technology and data to enhance not only tenant engagement but also operations and employee performance seems the new norm. However, there is always a risk of tunnel vision—value creation should be more than mere investments in new technologies. It requires a change in mindset. Companies have to break existing silos among people and processes. They have to learn to collaborate intentionally, both internally (different functions) and externally (fintech startups, customers and tenants, government, and peers). RE companies also need to be more fluid with processes and talent. Finally, companies should communicate more frequently and regularly with various internal and external stakeholders.

RE executives should take a step back and reflect on their current operating model and its readiness to adapt to the changing rules of the game. There isn’t a one-size-fits-all approach. We believe a winning formula will likely be driven by a focused commitment and degree of aggressive risk-taking on conducting business in a new and different way.

We believe a winning formula will likely be driven by a focused commitment and degree of aggressive risk-taking on conducting business in a new and different way.